The Asia-Transpacific route remains one of the world's busiest maritime corridors, connecting Asia's manufacturing powerhouses with North American consumer markets. Connecting manufacturing centres in Asia with ports throughout North America, this route facilitates the movement of approximately 22 million TEUs each year. For shippers and logistics professionals, understanding the nuances of this trade lane—from port selection to carrier alliance dynamics—is essential for optimising supply chain performance and controlling costs.

This comprehensive guide covers essential insights on routes, ports, and logistics strategies for successful ocean freight operations. Contact our logistics specialists to get a tailored proposal.

Primary Shipping Routes

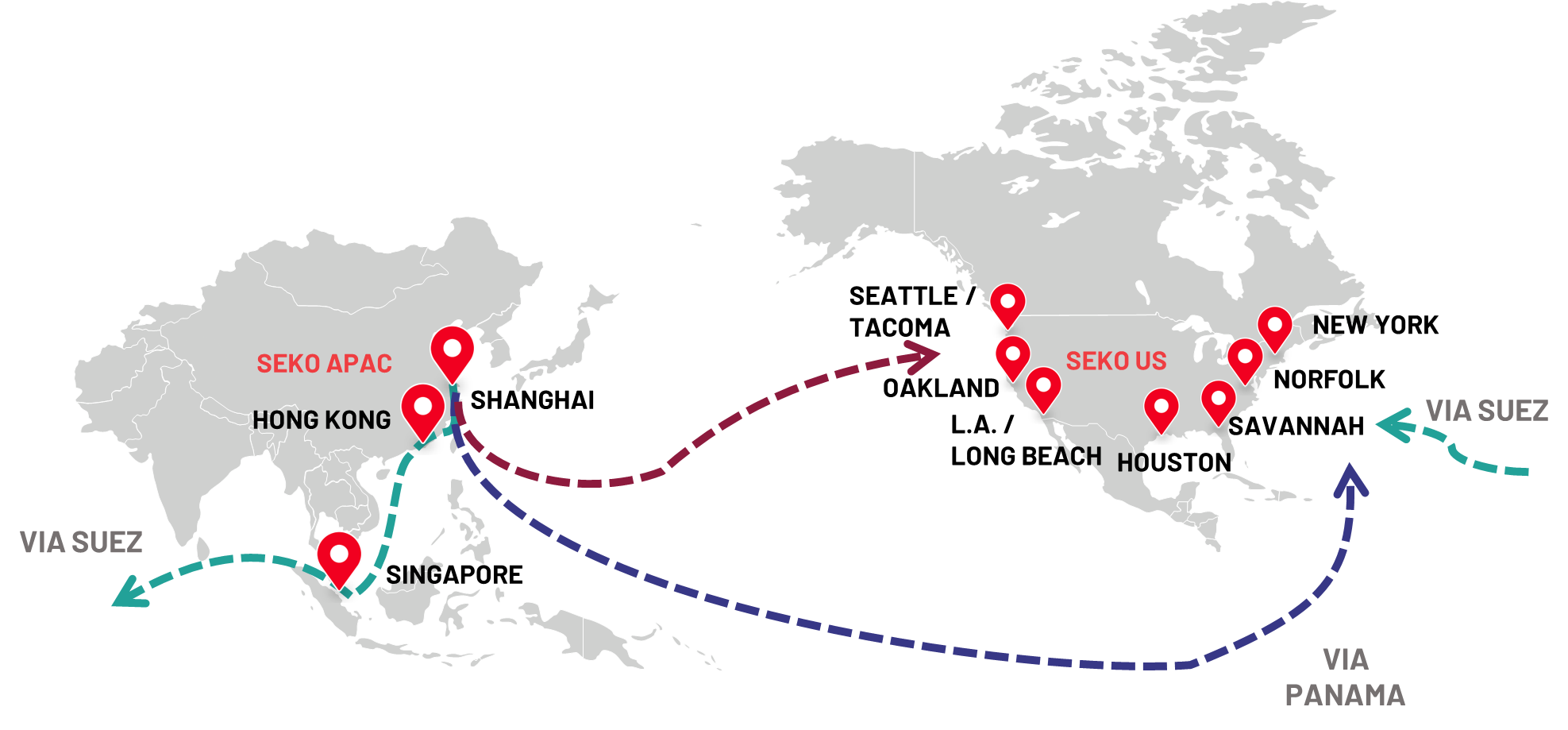

Container vessels operating on the Transpacific trade lane follow three primary routing options, each with distinct advantages depending on your cargo's final destination and time sensitivity.

Key Routing Options for Asia-North America Cargo

- Asia to US West Coast (Direct) — The fastest option for destinations in the Pacific states, with cargo arriving at ports like Los Angeles, Long Beach, Oakland, Seattle, and Tacoma.

- Asia to US East Coast via Panama Canal — Ideal for East Coast and Gulf destinations, avoiding West Coast congestion while serving ports from New York to Houston.

- Asia to US East Coast via Suez Canal — An alternative routing that can offer competitive transit times for certain origin-destination pairs, particularly from South and Southeast Asia.

Major Asian Origin Ports

Asian ports serve as the origin points for Transpacific cargo, with specific ports excelling in different regions. Understanding port capabilities and carrier service patterns helps optimise booking decisions.

| Region | Key Ports |

|---|---|

| North Asia | Busan (South Korea), Yokohama (Japan) |

| Central North China | Xingang (Tianjin), Qingdao, Shanghai, Ningbo |

| South China | Xiamen, Yantian, Shekou, Nansha |

| Taiwan | Kaohsiung |

| Southeast Asia | Singapore, Port Klang, Ho Chi Minh City, Haiphong, Laem Chabang |

Note: Port calls are subject to variations in carrier service strings. Non-direct call ports may be subject to origin arbitrary charges. For Transpacific trade, carriers typically apply rates based on the container gate-in date.

US Destination Ports

US ports are organised into distinct coastal regions, each serving different inland markets and offering various connectivity options for final mile delivery.

| Region | Key Ports |

|---|---|

| Pacific Northwest (PNW) | Seattle and Tacoma serve as primary gateways for cargo destined for the Pacific Northwest, with strong rail connections to inland markets. |

| Pacific Southwest (PSW) | Los Angeles and Long Beach form the largest US port complex, handling the majority of Transpacific cargo with extensive intermodal networks. |

| East Coast | New York, Norfolk, Savannah, Charleston, and Jacksonville serve the eastern seaboard with growing capacity and shorter transit to East Coast consumers. |

| Gulf Coast | Houston, Mobile, and Miami provide alternatives for cargo destined for the southern and central United States. |

Intermodal Options: IPI and RIPI

Understanding intermodal terminology is essential for optimising inland cargo movements. Two key concepts govern how cargo moves from port to final US destination:

Interior Point Intermodal (IPI)

IPI moves cargo from West Coast ports inland via rail or truck using a single bill of lading. This simplifies logistics documentation and provides seamless door-to-door service. Common IPI destinations include Chicago, Memphis, Dallas, and Kansas City.

Reverse Interior Point Intermodal (RIPI)

RIPI involves cargo arriving at East Coast ports and moving inland or westward, often via Panama Canal routing. This approach can help avoid West Coast congestion. Popular RIPI destinations include Chicago, Atlanta, and Charlotte.

Learn more at IPI vs. RIPI: What's the Difference?

Key Operational Considerations

Successfully managing Transpacific shipments requires attention to several critical operational factors:

Contract Validity

TPEB contracts run from 1 May to 30 April of the following year. All surcharges apply throughout the contract period unless otherwise specified.

Rate Structure

Rates are applied based on the container gate-in date. For multiple containers under the same bill of lading, the rate is determined by the last container's gate-in date.

FMC Filing

Filings must be completed before container gate-in. Otherwise, carriers reserve the right to apply tariff rates to the shipment.

AMS Requirements

Automated Manifest System (AMS) filing is required before vessel departure for all US-bound shipments.

Seize the Tariff Window: Act Now Before November 2026

The clock is ticking on one of the most significant trade opportunities in recent years. Following the agreement made in October, US-China tariffs have moderated from their peak of 145% to an effective rate of approximately 29.3%—but this reduced rate window extends only until November 2026. For businesses sourcing from China, this creates a strategic imperative: optimise your Transpacific shipping strategy now while conditions remain favourable.

Market conditions are aligning in shippers' favour. Fleet capacity expanded 9.7% in 2024, with projections of continued 8.7% annual growth through 2028. The container ship orderbook has reached a record 8.3 million TEUs—representing 27% of the existing global fleet. This capacity influx, combined with moderating demand growth of just 2.4% projected for 2025, creates a buyer's market for ocean freight. Spot rates have corrected significantly from their July 2024 peaks, and contract negotiations offer opportunities for competitive long-term rates.

However, timing is everything. As the November 2026 deadline approaches, expect a surge in frontloading activity similar to the patterns witnessed throughout 2024-2025. Shippers who waited until the last moment faced capacity constraints, premium rates, and extended transit times. Those who planned ahead secured better rates, reliable space allocations, and smoother customs clearance.

SEKO Logistics stands ready to help you capitalise on this window. Our established presence across major Asian origin ports—from Hong Kong and Shanghai and Singapore and Ho Chi Minh Port—combined with our extensive US network spanning over 40 locations, positions us to deliver seamless door-to-door Transpacific solutions. Whether you require direct West Coast routing for speed, all-water Panama Canal service for cost efficiency, or Interior Point Intermodal connections to inland destinations like Chicago, Memphis, or Dallas, our ocean freight specialists will design the optimal solution for your supply chain.

Don't Let This Opportunity Pass

Contact SEKO Logistics today to discuss your Transpacific shipping requirements. Our team will provide a comprehensive assessment of your current routing, identify cost-saving opportunities, and develop a strategic shipping plan that maximises the reduced tariff window while building resilience into your supply chain for whatever comes next.