The Asia-Europe route stands as the world's most significant container shipping corridor, enabling vital global trade flows between Asia's manufacturing hubs and Europe's major consumer markets. In 2025, approximately 19.6 million TEUs will be transported from Asia to Europe—representing 10.3% of all global container movements.

For logistics professionals and shippers, understanding this trade lane's dynamics is essential. From evolving routing patterns to port selection strategies, mastering Asia-Europe shipping directly impacts supply chain efficiency, transit reliability, and overall costs.

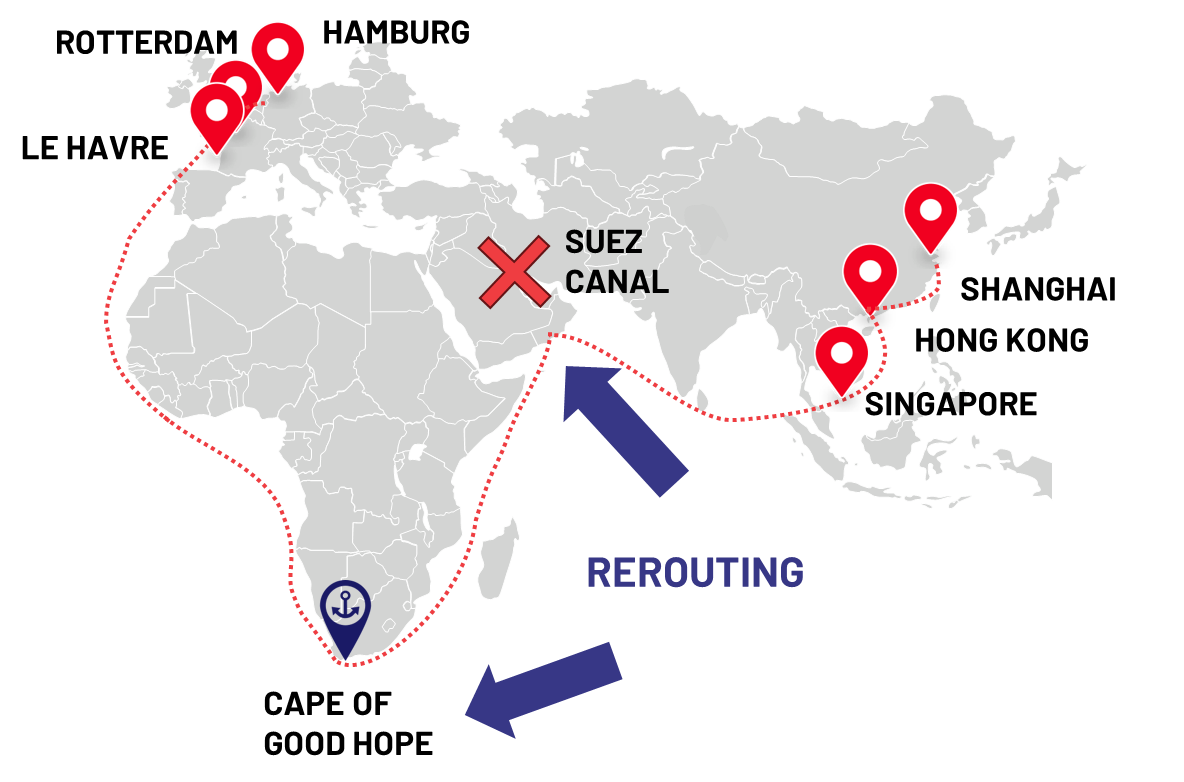

Current Routing Situation: Cape of Good Hope vs. Suez Canal

Since late 2023, the Asia-Europe trade lane has experienced significant routing disruptions. Due to security concerns in the Red Sea region, major carriers have rerouted vessels via the Cape of Good Hope instead of the traditional Suez Canal passage.

The Cape of Good Hope route adds approximately 7–14 days to transit times compared to the Suez Canal passage. This change has significant implications for supply chain planning:

- Extended transit times: Approximately 2 weeks added per voyage

- Increased operational costs: Higher fuel consumption and vessel deployment requirements

- War risk insurance premiums: Red Sea transits now carry premiums of 0.5%–1.0% of hull/machinery value, compared to 0.0001% in the Persian Gulf

| Region | Current War Risk Premium (% of H&M value) | Pre-crisis/Baseline Premium (%) |

|---|---|---|

| Red Sea | 0.5% – 1.0% (peaking at 2%) | ~0.1% – 0.3% |

| Persian Gulf | 0.2% – 0.5% | ~0.05% – 0.125% |

Major Asian Origin Ports

Asian origin ports span multiple countries and serve as crucial departure points for Europe-bound cargo. Understanding each port's capabilities and carrier service patterns enables more strategic booking decisions.

| COUNTRY | KEY PORTS |

|---|---|

| South Korea | Busan |

| Greater China | Tianjin, Qingdao, Shanghai, Ningbo, Xiamen, Yantian, Shekou, Kaohsiung |

| Singapore | Singapore |

| Vietnam | Ho Chi Minh City |

Note: Port calls are subject to variations in carrier service strings and arrangements. For other Asian ports or inland cities, standard arbitrary charges will apply.

European Destination Ports

European ports are organised across three major regions: North Europe, West Mediterranean, and East Mediterranean. Each region offers distinct advantages depending on cargo destinations and supply chain requirements.

| REGION | COUNTRY | PORT NAME |

|---|---|---|

| North Europe | Germany | Hamburg , Bremenhaven,Wilhelmshaven |

| Netherlands | Rotterdam | |

| Belgium | Antwerp, Zeebrugge | |

| France | Le Havre , Dunkerque | |

| United Kingdom | Felixstowe , Southampton , London Gateway | |

| Poland | Gdansk | |

| West Med | Italy | Genoa , La Spezia, |

| Spain | Barcelona , Valencia, Algeciras | |

| France | Marseille / FOS | |

| East Med | Greece | Piraeus |

| Turkey | Istanbul , Izmir . Mersin | |

| Israel | Haifa / Ashdod | |

| Egypt | Alexandria , Port Said |

Strategic Shipping Considerations

Trade volume growth on the Asia-Europe corridor influences carrier planning, port investments, and alliance formations globally. Shippers should consider several strategic factors when planning their ocean freight operations:

Transit Time Planning

With current Cape of Good Hope routing, build additional buffer time into supply chain schedules. Standard transits now range from 35–45 days depending on origin and destination.

Carrier Selection

Different alliances offer varying service frequencies and port coverage. Match carrier selection to your specific origin-destination requirements and reliability priorities.

Cost Management

Longer routings impact fuel costs and surcharges. Monitor carrier pricing structures and consider contract strategies to manage rate volatility.

Port Selection

Evaluate discharge port options based on inland connectivity, transit times, and current congestion levels. Mediterranean ports may offer faster access to Southern European markets.

Navigate Rising Costs: Prepare Your Asia-Europe Supply Chain Now

The regulatory landscape for Asia-Europe shipping is transforming rapidly—and the cost implications are substantial. EU Emissions Trading System surcharges nearly doubled in 2025 as coverage increases from 40% to 70%, with full implementation at 100% reaching by 2026. Combined with FuelEU Maritime regulations now in effect, per-TEU environmental compliance costs could reach €105 depending on vessel efficiency and routing. The question isn't whether these costs will impact your business—it's how prepared you are to manage them.

Adding to the complexity, the EU is abolishing its €150 customs duty exemption for low-value imports. From early 2026, transitional duty calculations take effect, followed by new e-commerce handling fees in November 2026. For businesses shipping consumer goods from Asia to European customers, this represents a fundamental shift in landed cost calculations.

Meanwhile, Red Sea diversions continue pushing vessels around the Cape of Good Hope, adding 10–14 days to transit times and approximately 30% more fuel consumption—costs that ultimately flow through to shippers while generating additional ETS liabilities. The environmental paradox is clear: longer routes mean higher emissions and greater regulatory exposure.

Smart businesses are acting now. With fleet capacity growing faster than demand, 2026 offers opportunities to secure favourable contract rates while optimising your European distribution strategy. SEKO Logistics operates fulfilment centres across the United Kingdom, Netherlands, and France—enabling you to position inventory closer to EU customers, reduce customs complexity, and minimise environmental surcharge exposure.